Trade shows can be a great place to advertise your services if you want your products and services to be known in your region. While they can be expensive and difficult to stand out from the crowd, they can bring in a large amount of potential clients. However, it's important to make sure your ads are as visible as possible.

Business owners

A business owner's unique perspective and needs make them a great target market for a financial advisor. It is important that you emphasize your connections to business owners as well as the products and services that can help them achieve their financial goals. Because they are influential and can provide great referrals, business owners can be an excellent source.

Investments are best viewed from the perspective of businesses. Business owners may be more knowledgeable about the risks and principals of investment decisions than others, which could lead to them being more familiar with different investment strategies. They may be more comfortable with investing in different types and may be more open-minded to other options.

Millennials

A personal touch and authentic social media presence are two ways to appeal to Millennials. Highlight your interests. Let clients know why you care about them. This will help you establish trust with Millennial prospects. This generation is short-attention span, so it's easier to reach them via content marketing strategies that highlight your unique benefits.

Millennials are increasingly using the internet to find financial advice. While older generations rely on networks, word-of-mouth and in-person opportunities, younger people value personal references and the convenience of the internet. Search engine optimization is a way to make your search engine more effective. For example, young people might type phrases such "best financial advisor New York City".

Millennials are parents to children

Millennials are a key target market for financial advisors. This generation is interested in learning how to get the best out of their money, and how to preserve it. They are open-minded and ambitious. They also value freedom and choice. This group may be particularly interested in investment strategies that can help them reach their goals sooner. Financial advisors have a strong cross-selling opportunity with Millennials who have children.

Although most millennials are not wealthy enough to warrant marketing to them in the first place, there may be some advisors who can make a profit and provide valuable learning opportunities for those already working as financial advisors. For example, a large practice may reach out to the millennial children of its HNW clients to build a multigenerational practice. This strategy is a great way to keep clients' assets intact and attract new clients.

Millennials save for retirement

Financial advisors should target the millennial market. This generation is breaking the stereotypes of careless spending, and they are applying lessons learned from past financial crises. Advisor Authority and Nationwide Retirement Institute found that 49% of Millennials who have more than $100,000 in retirement savings cited 2008's Financial Crisis as their most traumatic event. They were followed by 2020's global pandemic.

Millennials have started saving for retirement earlier than previous generations, but they are also anxious about whether they'll have enough savings. Many millennials want to save more money in order to retire early. Companies must tailor their messages and create buyer personas to reach this market.

Baby boomers

A variety of reasons should make Baby boomers a target for financial advisors. Morgan Stanley's recent survey found that the boomers are more likely to pass their wealth to their children than their parents. As the boomers reach their prime earning years, they have made a huge contribution to their retirement accounts. They also paid down their mortgages. They are interested in working with a financial advisor who can guide them through investing's complexities.

Planning for the financial future of baby boomers can be difficult because there are so many new 'firsts' in this generation. Therefore, there aren't many precedents. These changes include the reforms to healthcare and pension. Boomers are also more educated and independent than the previous generations, and have access to more information than ever before.

FAQ

Do I have the right to pay upfront for my purchase?

You don't have to pay until you get your final bill.

Many life coaches do not charge an upfront fee, which makes it simple to benefit from their expertise without having to spend any money.

If you do decide to hire a Coach, you will need a price agreement before you begin your relationship.

Can a life coach help you lose weight?

A coach may not be able help you lose weight. However, they can advise on ways to reduce stress levels and create healthier habits.

This means that a coach can help make positive changes to your life, such as improving your diet and alcohol consumption, exercising more frequently, and better managing your time.

What are the steps involved in life coaching

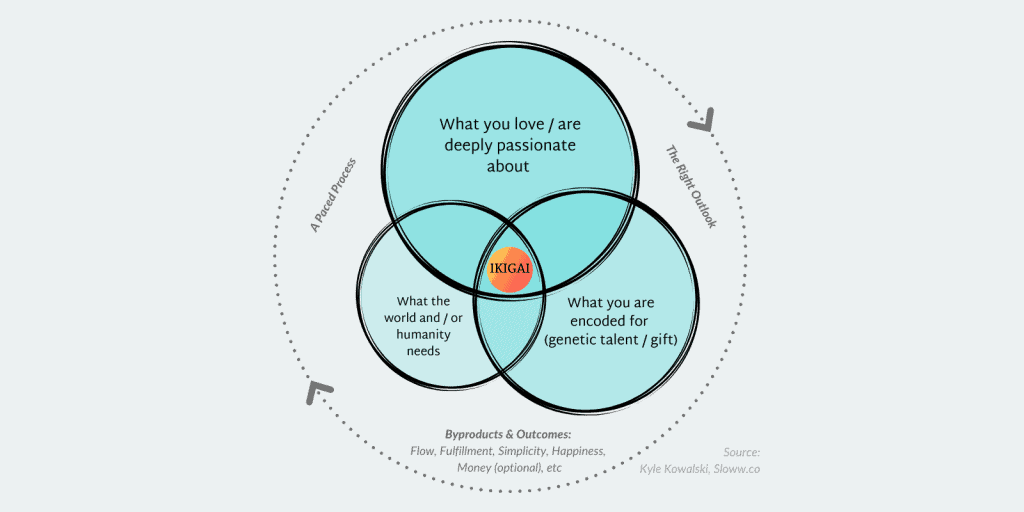

Life coaching isn't about solving problems. It's also about helping people discover their passions, and how they can apply this passion to improve their lives.

Life coaching helps identify the things that matter most to you and gives you the tools to make the life you want. It helps you take control of your future by discovering who you are and where you want to go.

In addition, I believe coaching helps you develop an understanding of yourself and others, leading to greater self-awareness and empathy - two essential qualities for a healthy relationship. Coaching gives you tools that will help make you a better parent or friend.

What are the life coaching benefits?

A life coach helps you live a better life by helping you achieve goals, overcome obstacles, change habits and become happier.

A life coach helps people to improve their self-awareness and confidence, increase productivity, improve relationships, and motivate themselves.

A life coach is your key to success!

Statistics

- These enhanced coping skills, in turn, predicted increased positive emotions over time (Fredrickson & Joiner 2002). (leaders.com)

- According to a study from 2017, one of the main reasons for long-term couples splitting up was that one of the partners was no longer showing enough affection and attention to the other. (medicalnewstoday.com)

- If you expect to get what you want 100% of the time in a relationship, you set yourself up for disappointment. (helpguide.org)

- According to ICF, the average session cost is $244, but costs can rise as high as $1,000. (cnbc.com)

- According to relationship researcher John Gottman, happy couples have a ratio of 5 positive interactions or feelings for every 1 negative interaction or feeling. (amherst.edu)

External Links

How To

What is a Life Coach? How can they help you?

A life coach is someone who helps people improve their lives through advice on personal development and career guidance, relationship counseling or business coaching, financial planning, wellness, and other topics.

A life coach offers support and guidance to those who wish to make positive lifestyle changes. A life coach can also help those who are struggling with anxiety, depression, addiction, grief and stress, loss, trauma, trauma, or any other issues.

Life coaches use many techniques to help clients realize their goals. Motivational interviewing is a popular method that helps clients set goals, achieve their goals, use self-reflection, assertiveness and cognitive behavioral therapy.

As an alternative to traditional psychotherapy, life coaching emerged. While coaching is typically less expensive than traditional psychotherapy, it offers similar services. Life coaches are often experts in a particular area, such parenting or love relationships. Some coaches specialize in working only with adults, while others focus on helping children or teenagers. Other coaches may have other expertise, such as in education, sports performance, nutrition, or fitness.

There are many benefits to life coaching.

-

To help people reach their goals

-

Relationship improvement

-

How to deal with problems

-

Overcoming challenges

-

Improving mental health

-

You can learn new skills

-

Developing confidence

-

Motivation increases

-

Building resilience

-

Finding meaning in life

-

Making healthy lifestyle choices

-

Reducing stress

-

The art of managing emotions

-

Discovering strengths

-

Enhancing creativity

-

Work through changes

-

Coping with adversity

-

How to solve conflicts

-

Peace of mind

-

Improve your finances

-

Boosting productivity

-

Fostering happiness

-

You can maintain balance in your everyday life

-

Navigating transitions

-

Strengthening community connections

-

Being resilient

-

Healing from losses

-

Finding fulfillment

-

Optimizing opportunities

-

Living well

-

Leadership

-

Achieving success

-

Academic success or work success

-

Getting into college or graduate school

-

Moving forward after divorce